We are really looking forward to attending the Women Angels of the North Investment Forum next week in Leeds and meeting some of the influential women who are funding entrepreneurs. This is a fantastic event for women from the Northern Regions interested in hearing more about Women Angel Investing. If you’re interested in attending then please REGISTER HERE or CLICK HERE to find out more.

Category: Latest News

We’ve had a really busy couple of weeks running our pitching sessions and being part of the Digital Shift Summit and the Best of Both Hubs – Finance for Growth events. Both events were fantastic and we really enjoyed running our Investor Readiness training sessions as part of the workshops. We met some exciting businesses and are really looking forward to supporting some of them in their funding journey. Before the end of October we have 3 more pitching events as well as running another of our Investor Readiness sessions. If you’re looking for funding or wanting to learn more then just get in touch – we would love to hear from you.

We are delighted to be speaking at the Best of Both Hubs – Finance for Growth event in October. We will be talking in the Alternative Finance workshop, there are some great speakers as well as some other fantastic workshops.

REGISTER HERE to secure your place.

We are delighted to be running workshops at the Digital Shift Summit in a few weeks time. The Digital Summit invites digital businesses to a series of introductory workshops focused on the range of support available. Workshops will focus on topics of digital techniques, funding and investments for growing businesses and good business techniques. Each two hour workshop will provide businesses with information, case studies and top tips.

The event will run between the 27th and 29th of September in Halifax.

We are running two Investor Readiness workshops on both the 27th and 29th.

These workshops will cover:

- Is investment right for you

- What type of investment

- Valuation – what is your strategy

- What an investor is looking for

- What does your perfect investor look like

- Pitching for investment

To register and secure your place for the 27th of September CLICK HERE

To register and secure your place for the 29th of September CLICK HERE

We are running an Angel Only Event in York on the 4th of September where there will be a range of speakers covering the latest Angel research, SEIS/EIS tax, the legal challenges around Angel Investing, a detailed case study putting everything into context and concluding with a panel of investors taking open questions from the audience.

Following this educational piece, we will be putting on our first speed pitching session! This will be a fun and exciting way of hearing from businesses who are looking for funding and support. To conclude the event there will be a networking opportunity, where you can follow up with any businesses that were of interest.

This event is aimed at existing Angels or those interested in becoming an Angel Investor. To secure your place REGISTER HERE.

(Following your registration we will be in touch with regards to a little paperwork. We will need you to sign either a High Net Worth or Sophisticated Investor form – FCA rules, sorry. This doesn’t committ you to anything but allows us to have you attend this kind of event. If you have any questions then please don’t hesitate to contact us)

We are running an Angel Only Event in Leeds on the 29th of August where there will be a range of speakers covering the latest Angel research, SEIS/EIS tax, the legal challenges around Angel Investing, a detailed case study putting everything into context and concluding with a panel of investors taking open questions from the audience.

Following this educational piece, we will be putting on our first speed pitching session! This will be a fun and exciting way of hearing from businesses who are looking for funding and support. To conclude the event there will be a networking opportunity, where you can follow up with any businesses that were of interest.

This event is aimed at existing Angels or those interested in becoming an Angel Investor. To secure your place REGISTER HERE.

(Following your registration we will be in touch with regards to a little paperwork. We will need you to sign either a High Net Worth or Sophisticated Investor form – FCA rules, sorry. This doesn’t committ you to anything but allows us to have you attend this kind of event. If you have any questions then please don’t hesitate to contact us)

We’re running an Investment Readiness breakfast session with Wizu Workspaces in Leeds on the 13th of September.

Subjects covered will include: Is Angel Investment right for you, the difference between Crowdfunding and Angel Investing, other funding options and concluding with a Q&A session. This event would be great for businesses who are looking for funding or those interested in exploring their options/expanding their knowledge.

Secure your place now by REGISTERING HERE

The most recent report published by the Britsh Business Bank stated that:

- 86% of Angels invest because of SEIS/EIS

- 78% of Angels invest in riskier businesses because of SEIS/EIS

- 87% of deals used SEIS/EIS

So, what is SEIS/EIS and how do you qualify?

S E E D E N T E R P R I S E I N V E S T M E N T S C H E M E

SEIS (Seed Enterprise Investment Scheme) is there to help your business raise money when it’s starting to trade, by offering tax reliefs to individual investors buying shares in the business. It’s important to note that this isn’t relief for the business but for the Investors, which in turn benefits the business by making the investment proposition more appealing.

You can receive a maximum of £150,000 through SEIS investments on which your Investors can claim relief. The money you raise from the investment must be spent within 3 years from the share issue and must be spent on the qualifying business activity it was raised for.

You can ask HMRC if your share issue is likely to qualify before going ahead, this is called advanced assurance.

For a full understanding on SEIS, how to apply and if you qualify CLICK HERE.

E N T E R P R I S E I N V E S T M E N T S C H E M E

EIS (Enterprise Investment Scheme) offers tax relief to individual Investors who buy new shares in your business to help it grow.

Under EIS, you can raise up to £5million each year, and a maximum of £12million in your Company’s lifetime. It’s worth noting that tax reliefs will be witheld/withdrawn from your Investors if you fon’t follow the rules for at least 3 years after the investment is made. The money raised by the new share issue must be used for a qualifying business activity, which is:

- A qualifying trade

- Preparing to carry out a qualifying trade

- Research and development that’s expected to lead to a qualifying trade

For a full understanding on EIS, how to apply and if you qualify CLICK HERE.

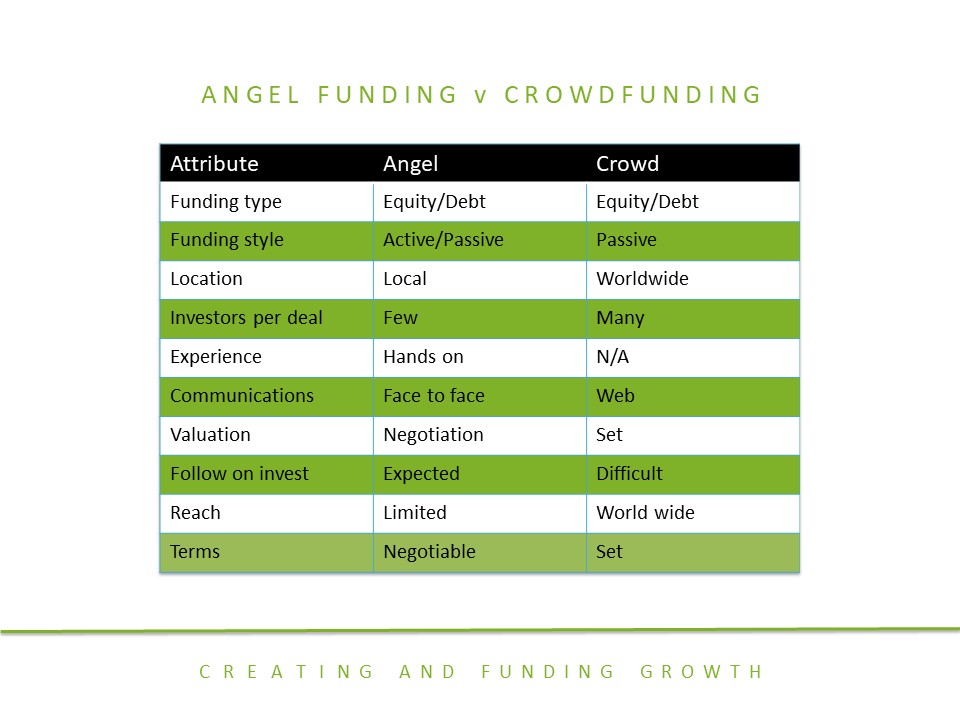

We regularly get asked about the fundamental differences between angel funding and crowdfunding. One of the main differences that separate the two is that angel investment is largely active, as opposed to crowdfunding which is passive. This is especially true of our own network of angels, who not only provide investment, but support and mentoring. Research suggests angel investment can significantly improve the growth and success of a business.

Crowdfunding reaches a worldwide audience while angel investment tends to be local. This is especially important if a business is looking for support. Our network of angel investors have a vast amount of knowledge and experience, and have quite literally ‘been there and done it’. This helps founders avoid the common pitfalls that others experience, as they learn from angels who have not only made the mistakes, but learnt from them.

We have detailed some of the key differences in the table below:

We are running a FREE Investor Readiness Training session in Leeds that we would like to invite you to. This event will cover the following topics:

- Is investment right for you

- Angel or Crowd Funding

- Valuation – what is your strategy

- What an angel is looking for

- What does your perfect angel look like

- Pitching for investment